The Ultimate Guide to Picking the Perfect Credit Card (Without Getting Burned)

Compare Cards. Find the Right One for You.

Not sure which card fits your lifestyle?

Use the tool above to get personalized credit card recommendations based on how you spend.

Click here to repair your credit in minutes

Choosing a credit card might seem simple at first glance, but picking the wrong one can cost you big time. Whether you’re looking to earn rewards, build credit, or just have a reliable card for emergencies, the right choice depends on more than just a flashy sign-up bonus. Let’s break down what really matters when choosing a credit card—including some things most people don’t tell you.

What Everyone Looks at First (and Should)

Most people begin their search by comparing a few key features. That’s a smart place to start. Here are the big ones:

Interest Rate (APR)

This is the percentage you’ll be charged on balances you don’t pay off. If you might carry a balance, a low APR is critical.

Fees

Annual fees, late fees, foreign transaction fees, balance transfer fees—they can add up quickly. Look beyond the rewards and read the fine print.

Rewards and Perks

From cashback and travel points to gas discounts, rewards can add real value—but only if they align with your spending habits.

Credit Score Requirements

Not all cards are available to everyone. Know your credit score before applying to avoid unnecessary rejections that can hurt your credit.

Introductory Offers

Some cards offer 0% APR for the first 12+ months or hefty bonuses for early spending. These can be great for large purchases or paying off debt.

What Nobody Tells You (But You Should Definitely Consider)

Here’s where the hidden costs or benefits often live:

Grace Period

This is the window between your purchase and when interest starts accruing. Some cards have no grace period, others give 25+ days.

Penalty APR

Miss a payment and your APR could spike permanently. Know if the card has a penalty rate and how severe it is.

Balance Calculation Method

This determines how interest is calculated. Most use average daily balance, but some use more aggressive methods that cost more.

Reward Expirations or Caps

“Unlimited cashback” isn’t always unlimited. Watch for category restrictions, quarterly caps, or points expiration dates.

Digital Wallet Compatibility

Use Apple Pay or Google Pay? Not all cards integrate smoothly. Make sure yours does if you rely on contactless payments.

Hidden Benefits

Purchase protection, extended warranties, travel insurance—these “fine print” perks add real value if you know they exist.

Issuer Reputation

Customer service matters, especially in a dispute. Read reviews before committing.

Upgrade or Downgrade Paths

Some issuers allow product changes without opening or closing accounts, helping you preserve credit age and history.

Common Journey Before Choosing a Card

Everyone has a reason to start card shopping. Maybe it’s a trip, a big purchase, or paying off debt. The typical process looks like this:

- You set a financial goal (travel, credit building, reduce interest)

- You check your credit score

- You start Googling options

- You get overwhelmed and need help sorting priorities

If that’s you, you’re not alone. The key is to focus on how you spend money and what problem you’re trying to solve.

After You Choose a Card: What Next?

Congrats! Here’s how to set yourself up for success:

- Use prequalification tools before applying to protect your credit

- Set up auto-payments to avoid late fees

- Stay under 30% of your credit limit

- Track rewards or plan large purchases during promo periods

- Keep your credit utilization low and your account open to build history

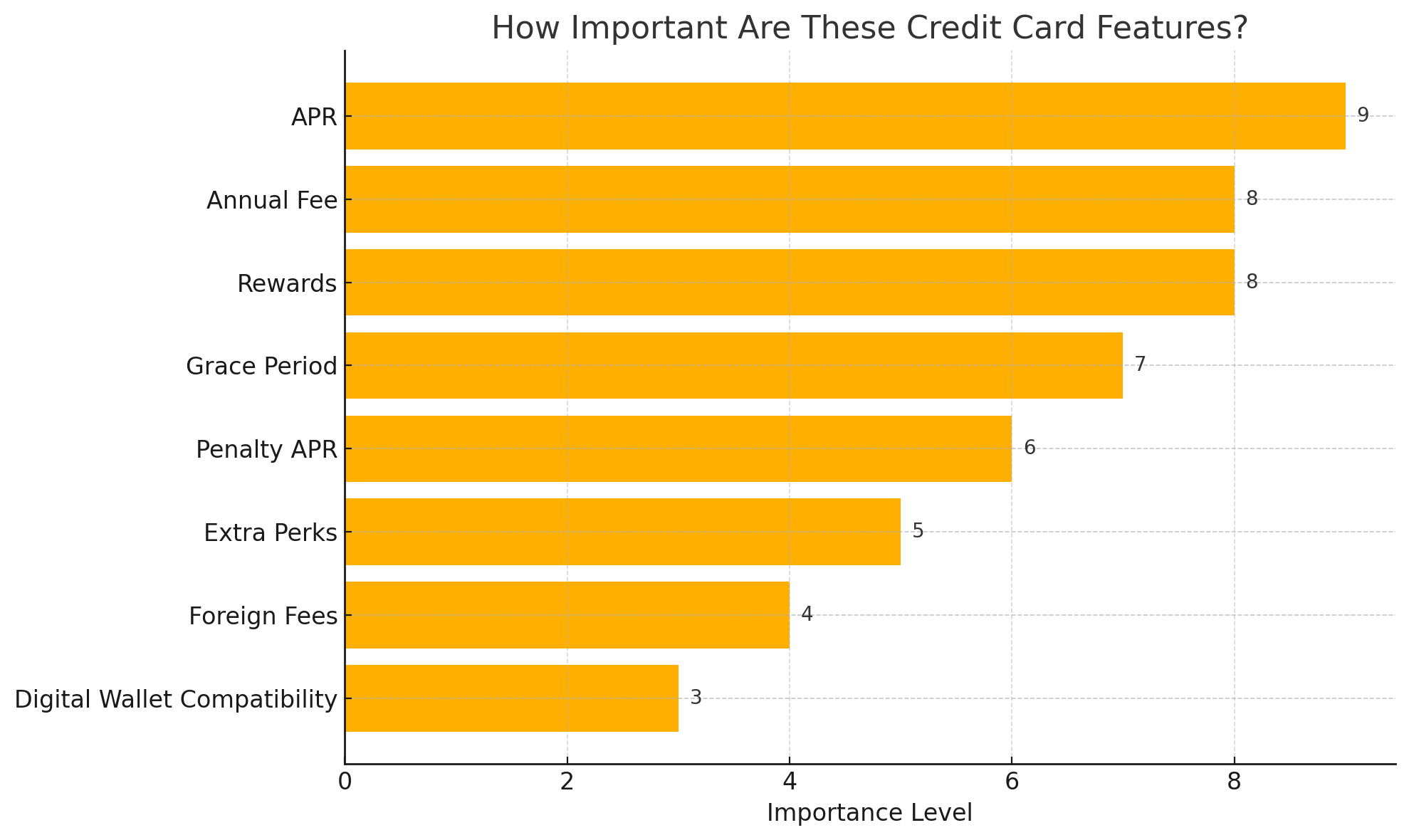

Quick Checklist for Comparing Cards

Want to compare options side-by-side? Jot these down:

-

- APR (intro & ongoing)

- Annual Fee

- Rewards structure

- Grace period

- Penalty APR

- Extra perks (insurance, warranty, etc.)

- Foreign transaction fees

- Digital wallet compatibility

Helpful Tools:

Credit Card Cashback Calculator

- What Is the RushCard, and Who Is It For?

- 5% Back, No Fee, and 12-Month Financing? The Fleet Farm Card Is a Hidden Gem

- Military Star Card: The Best Perk You’re Probably Not Using Right

- The Midas Credit Card: Lifesaver or Money Pit?

- Metrostyle’s Shutdown Left Loyal Shoppers in the Cold—Here’s What We Lost